"Why financial literacy matters more than ever, right now"- Finance whizz, Nicolette Mashile

Updated | By Stacey and JSbu

Did you know that July has been declared 'National Savings Month' by The South African Savings Institute?

This has been done to encourage South Africans to focus on finding better and, if needs be, alternative ways in finding saving solutions that work for them.

According to The Bureau for Economic Research, along with the devastating effects of the COVID-19 pandemic, as well as the third wave which has resulted in harsher lockdown regulations, and the events of the week of mass looting, damage, and violence in KwaZulu-Natal and Gauteng - economic activity will take an even bigger strain.

One of the most immediate impacts that will be experienced by us as consumers will be household consumption and production.

READ: Pick n Pay, Boxer stores gradually reopening in KZN, Gauteng

Our ECR News Watch team reported on some of the retail chains who had to temporarily close their facilities. A decision that was taken as a precautionary measure for some, whilst for many because they simply did not have a choice as their premises were looted and damaged.

Last week, Durban residents, searching for groceries, say some food suppliers who began popping up in the wake of the unrest had been exploiting the situation by overcharging for basic goods.

READ: Some Durban food suppliers accused of overcharging for basic goods

The long term damage may be the most devastating, however, when it comes to production capacity, infrastructure, and other facilities, the BER said.

READ: WATCH: Riots force KZN farmers to dump 28k litres of milk daily

The SA Property Owners Association (Sapoa) estimates that about 800 of their stores have been looted and/or severely damaged, while 100 malls have sustained significant fire damage.

READ: Riots, looting 'final nail' in economic coffin

Earlier last week, economist Mike Schussler said the looting is a big knock to many industries and small businesses that are still suffering the losses of lockdown.

Job secruity is also at stake. Thousands of people may be without jobs following the unrest of the week that was. This morning already, Msunduzi Mayor Mzimkhulu Thebolla shared that about 2,200 workers at the Edendale Mall have lost their jobs.

So, where to for ordinary South Africans?

For those fortunate enough to still have employment or other means of making an income, some creative ways may be needed to help save and grow their money.

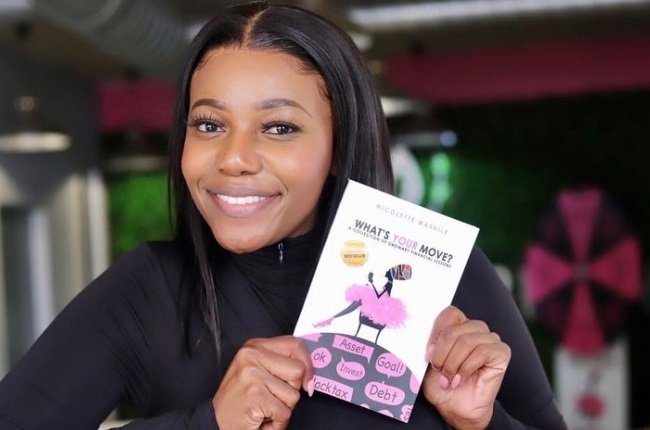

Stacey and J Sbu contacted finance whizz Nicolette Mashile, popularly known as South Africa's financial bunny, for her comment on the state of the economy and her advice on some money saving tips that can help.

Listen to the podcast below:

In addition, The South African Savings Institute lists the following tips to help in saving:

1. Set a target

The reason why many of us do not save is because we do not have set targets. It is important to set and write down important savings targets such as an emergency fund, a holiday fund, and other targeted savings.

2. Automated savings

Debit orders to savings accounts allow automated saving. You can set up debit orders for Tax-free Savings Accounts (TFSA), 32 Day Notice Accounts, and Unit Trust Accounts.

3. Your 13th cheque

Ask your payroll manager to save for a 13th cheque, paid to you in December, by lowering your salary. This extra pay cheque will allow you to ride out the festive period and expenses in the new year without these having a major impact on your finances.

4. Pension fund contributions

When starting a new job, ask your employer to default to the highest allowable retirement fund contribution percentage of your income. You can also ask your employer to review your current contribution. Best of all, all retirement funding contributions are tax deductible annually up to R350,000.

5. Financial Wellness days

Ask your employer to give mandatory time off to review your finances with a financial planner once a year. Regular meetings with a certified financial planning professional will help you remain in control of your finances.

Do you have any money saving tips?

Main image supplied by Nicolette Mashile.

Show's Stories

-

Python on M19: Nick Evans' hair-raising encounter

Snake rescuer Nick Evans shared a story of a huge python, yes you read t...

Stacey & J Sbu 9 hours ago -

WATCH: Teen who donated organs gets heroic send off

A teenager's final act of kindness will touch countless lives. A video s...

Stacey & J Sbu 10 hours ago